- In MACRO & CRYPTO NEWS, US signals rate rises in 2022, UK inflation hits new highs and crypto hits a bump

- In M&A NEWS, Fortress buys Punch Pubs but Cineworld is dealt a near-fatal blow

- In RETAIL NEWS, US retailers get a Christmas boost, Inditex posts record results and Currys powers through

- In MISCELLANEOUS NEWS, UK companies get jittery, pay keeps rising and EV subsidies get cut

- AND FINALLY, I bring you a tricky visit to Santa…

1

MACRO & CRYPTO NEWS

So the US talks interest rate rises, UK inflation hits new highs and crypto takes a hit…

📢 It’s Thursday – so it’s time for the FINAL weekly ZOOM call for SILVER and GOLD subscribers for 2021 where I will do a detailed review of the week before turning things over to Q&A and discussion. Today’s ZOOM call will start at 5.30pm and END AT 6pm (I have to be at an event at 6pm). See you there!

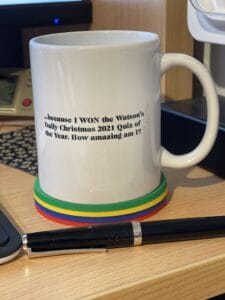

In addition to this, I will be releasing not one – but TWO competitions to keep the party going over the festive period! Firstly, there is the 🎄 Watson’s Daily Christmas Quiz 2021 🎄 where you can win a one-off mug (even I don’t have one of these – I got it custom-made!) and other goodies and secondly, we are going to do our first ever writing competition! You can try the quiz HERE (deadline is midnight December 23rd), but look out on our social channels for more details on the writing competition!

Fed signals three rate rises in 2022 (The Times, Callum Jones) highlights the future direction to be taken by America’s central bank, the Federal Reserve, as most of its policy-makers think that interest rates will rise at least three times during the course of next year in efforts to curb rising inflation. Meanwhile, UK inflation hits highest level in a decade (Financial Times, Chris Giles) reflects increasing pressure on the Bank of England’s Monetary Policy Committee (MPC) as the latest inflation figure of 5.1% for November is the highest it’s been for ten years and way above the Bank’s forecast of 4.5%. Despite doom-talk from the IMF, BoE likely to hold rates despite inflation worries, say economists (Financial Times, Chris Giles) shows that the general expectation is that the MPC will chicken out of raising interest rates, citing the uncertainties of Omicron as the main reason. Higher inflation looks set to be around for longer…

I thought it was worth mentioning Crypto challenge needs more than an ad man’s touch (Financial Times, Cat Rutter Pooley) because it highlights a move yesterday by the UK’s Advertising Standards Authority to warn seven crypto businesses for breaking advertising industry standards. Back in July it had warned companies against underplaying the risks involved but it can’t really punish them itself, although it can refer repeat offenders to the Competition and Markets Authority. There is debate as to whether crypto should be regulated by the Financial Conduct Authority – as it stands at the moment, crypto is outside its remit – but it has also been suggested that it should be overseen by the Gambling Commission. Still, the FCA’s own findings suggest that the proportion of investors who see crypto as gambling are falling as it edges closer to the mainstream and finance is what it does – so it needs to get involved pronto! IMO, I think they should take a note out of Elvis’ book – “A little less conversation, a little more action please…”. Uhuhuh.

On another note, here is part of what you could win by taking part in our Christmas Quiz! It won’t take you long and you could win this one-off bit of merch (plus a few other things!)…go ooooon! You know you want to 😜

2

M&A NEWS

Fortress buys Punch Pubs and Cineworld takes a massive hit…

Punch Pubs sold to US private equity investor Fortress (The Guardian, Jasper Jolly) shows that the British chain of 1,300 pubs has just been bought by the private investor who bought Majestic Wine and almost, but didn’t quite, buy Morrisons. In the mould of Morrisons, Punch owns over 90% of the freeholds of its properties, which is particularly attractive for Fortress as the easy thing to do first off is to do a sale and leaseback. The US invasion of British companies continues apace!

Then in Cineworld investors face wipeout after court ruling (Daily Telegraph, James Warrington and Oliver Gill) we see that shares in the British cinema chain cratered by almost 40% in trading yesterday on news that a Canadian court ordered Cineworld to pay £722m to Cineplex after reneging on a plan to buy the Canadian chain. Cineworld had originally moved to takeover Cineplex in 2019, but it was terminated in June 2020 as Cineworld said that Cineplex had been in breach of promises to keep debt under C$725m. Cineworld is planning to appeal, which could take up to a year. This judgment could be fatal to Cineworld. Can it be saved by an amazing box office in 2022?

3

RETAIL NEWS

US retailers get a boost, Inditex posts record results and Currys complains of shortages…

Some muted Christmas cheer for US retailers (The Times, Callum Jones) cites the latest figures from the US Department of Commerce which show that US retail sales rose in November, but by a lower amount than had been expected, as there had been a shift of spending from goods to services over the period. The overall belief remains that the economy is continuing to get its mojo back.

Meanwhile, in Europe, Zara-owner Inditex posts record results but Omicron casts shadow (Financial Times, Daniel Dombey) shows that although Inditex had a record Q3 a combination of some analysts expecting more and

the spectre of Omicron looming meant that the shares were weaker on the announcement. * SO WHAT? * Given that Q3 sales were 21% higher than Q3 in 2020 and 10% higher than in 2019, you would have thought that the shares would have performed better, but given the uncertainty of Omicron impact investors clearly decided to abandon.

In the UK, Currys hit by shortages of popular Christmas gifts (Daily Telegraph, Helen Cahill) shows that the consumer electronics retailer painted a downbeat picture of trading yesterday. It said supply chain problems had hit the availability of popular games consoles and beauty-related electricals and its share price fell by almost 12% on the news. * SO WHAT? * This is obviously disappointing, but then again I guess that everyone is in the same boat (and customers know this). It will be interesting to see whether demand continues into the new year and whether PC and laptop sales get another boost if more movement restrictions are put in place.

4

MISCELLANEOUS NEWS

Companies worry about another pingdemic, pay goes up and EV subsidies are cut…

UK companies warn about impact of Omicron staff shortages (Financial Times, Daniel Thomas, Gill Plimmer and Alice Hancock) shows that UK retail, manufacturing, travel and healthcare companies are getting increasingly concerned that there will be more staff shortages as the number of Omicron cases rise. Industry bodies like the United Kingdom Warehouse Association, Make UK and operators in health care are among those joining the chorus of voices asking the government to reinstate statutory sick pay and provide more home testing.

In the meantime, Pay deals grow at fastest rate for over a year (Daily Telegraph, Russel Lunch and Tim Wallace) cites data from XpertHR which shows that average pay

settlements are now 2.2%, the highest they’ve been since June 2020 as shortage of labour and higher inflation are putting increasing pressure on employers. If it wasn’t for Omicron, then surely the MPC would have been certain to raise interest rates in today’s meeting, no?

Then in a blow to some potential EV buyers, Ministers again cut subsidies for buyers of electric cars (Daily Telegraph, Howard Mustoe) shows that government grants for EVs have been cut from £2,500 to £1,500 for purchases of up to £32,000 – a level which had already been cut from £3,000 for purchases of up to £50,000 that had been available at the start of the year. * SO WHAT? * As you’d expect, cheerleader-in-chief of the Society for Motor Manufacturers and Traders, Mike Hawes, was up in arms about this, but let’s face it, I’d argue that most people who can afford an EV at the moment don’t really need this grant. Mike Hawes is just doing his job by whinging, but the fact is that EV sales have been rising under lockdown.

5

...AND FINALLY...

…in other news…

We’re coming up to that time where little ones go to Santa and share their hopes and dreams with him (for presents, that is). Well, one little boy had his plans sabotaged somewhat in Mum in tears as daughter’s caught grassing up ‘naughty’ older brother to Santa (The Mirror, Emma Rosemurgey). If only he’d bribed her with sweets beforehand…

Some of today’s market, commodity & currency moves (as at 0758hrs green is up, red is down). THIS IS INTENDED AS A ROUGH GUIDE ONLY!

| FTSE 100 * | Dow Jones * | S&P 500 * | Nasdaq* | DAX * | CAC-40 * | Nikkei ** | Shanghai ** |

| 7,171 (-0.66%) | 35,927.43 (+1.08%) | 4,709.85 (+1.63%) | 15,565.58 (+2.15%) | 15,476 (+0.15%) | 6,928 (+0.47) | 29,059 (+2.11%) | 3,674 (+0.71%) |

| Oil (WTI) p/b | Oil (Brent) p/b | Gold Per t/oz | £/$ | €/$ | $/¥ | £/€ | $/₿ |

| $71.58 | $74.51 | $1,784.69 | 1.32641 | 1.13053 | 114.11 | 1.17300 | 48,753 |

(markets with an * are at yesterday’s close, ** are at today’s close)